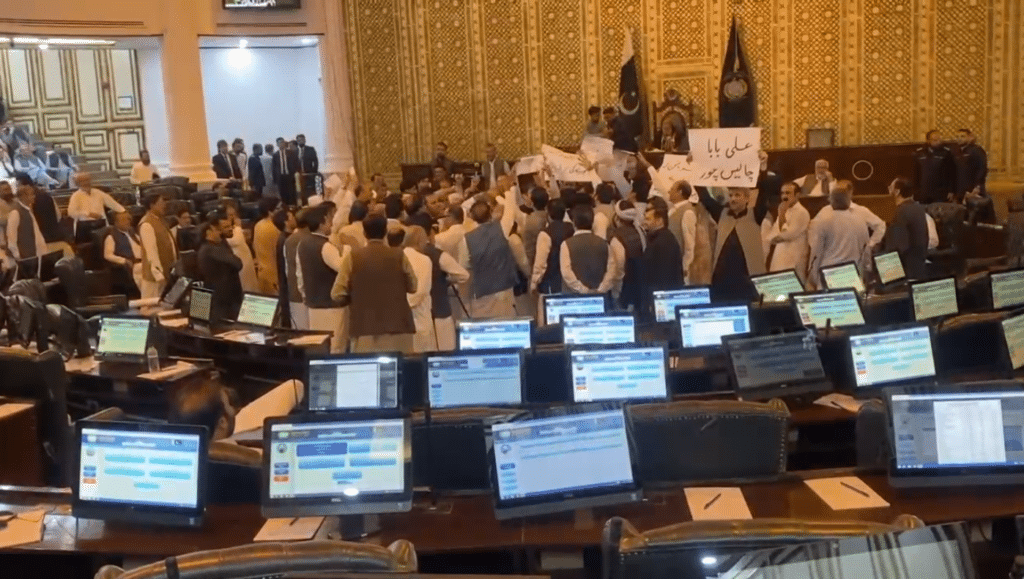

Khyber Pakhtunkhwa’s budget for the fiscal year 2025-26 was presented by Law Minister Aftab Alam Khan in the provincial assembly. The total budget estimate is Rs 2,119 billion, with an annual development program proposed at Rs 547 billion. The government has set a surplus budget target of Rs 157 billion.

During the presentation, Aftab Alam Khan criticised the previous caretaker government’s policies, stating they had led the province into a severe financial crisis. He noted that when the current government took power, there were only fifteen days’ worth of salaries left in the provincial treasury. However, by implementing a policy of fiscal discipline, the government not only resolved this crisis but also exceeded the previous year’s surplus target of Rs 100 billion.

The Law Minister referred to the current budget as a “historic surplus budget,” which is higher than the total surplus budgets of the past several years. In the budget, Rs 1,415 billion has been allocated for salaries, pensions, and other mandatory expenses. Of this, Rs 1,255 billion is proposed for ongoing expenditures in settled districts, while Rs 160 billion is allocated for tribal districts.

The budget proposes a 10 per cent increase in salaries for government employees and a 7 per cent increase in pensions. It also includes an announcement to raise the minimum monthly wage from Rs 36,000 to Rs 40,000. Additionally, there is a proposal to increase the disparity allowance from 15 to 20 per cent for government employees who do not receive executive allowances.

For health and other social sector reforms, Rs 7 billion has been allocated, including Rs 2.86 billion for health, Rs 700 million for minerals and industry, Rs 620 million for livestock, and Rs 550 million for municipalities and tourism.

Aftab Alam Khan accused the federal government of not fulfilling its financial commitments, highlighting a deficit of Rs 267 billion in the National Finance Commission (NFC) and pointing out that the federation owes Rs 71 billion in electricity net profits and Rs 58 billion in oil and gas.

The budget documents also estimate Rs 177 billion in foreign aid and grants for the province. Tax reforms proposed in the new budget include reducing the stamp duty on property allotment and transfer from 2 per cent to 1 per cent, lowering hotel bed tax from 10 to 7 per cent, and offering tax exemptions on 4.9 marla residential and commercial properties.

Additionally, there is a proposal to abolish professional tax for individuals with a monthly income of Rs 36,000, as well as waiving registration fees and token taxes for electric vehicles.

The Law Minister stated that the provincial government paid off outstanding loans worth Rs 49 billion last year, including Rs 18 billion as interest. To ensure fiscal discipline in the future, the government has mandated that any new loans must be approved by the Finance Department.

Law Minister Aftab Alam Khan is presenting the budget for the fiscal year 2025-26. He considers it a privilege to outline this budget.

During his budget speech, he emphasised that fiscal discipline policies were implemented, which helped control the deficit. The previous caretaker government’s wrong policies had led to a financial crisis in the province, leaving only 15 days’ worth of salary available in the provincial treasury.

In the last fiscal year, a budget surplus target of Rs 100 billion was set. Despite numerous obstacles, the province not only achieved this target but exceeded it. These obstacles included a reduction of Rs 42 billion in the National Finance Commission (NFC) allocation from the federation, a reduction of Rs 40 billion in the ongoing expenditure of merged districts, and a shortfall of Rs 1 trillion in federal tax targets.

This year’s budget is historic, presenting a surplus much greater than the combined surpluses of recent years. In the current fiscal year, a total of Rs 49 billion has been disbursed, which includes Rs 18 billion in markup.

The Finance Department has mandated that before taking on any new loans in the future, consultations must be held again with the department.

Significant reforms have been made, with a total of Rs 7 billion allocated across various sectors: Rs 2,860 million for health, Rs 700 million for minerals, Rs 700 million for industry, Rs 620 million for livestock, Rs 550 million for municipalities, and Rs 550 million for the tourism department.

For the current fiscal year’s development budget, the planned allocation for districts was estimated at Rs 120 billion. Thanks to better financial management, this amount has increased by about 30 per cent to Rs 155 billion.

Read also: KP finalises 177.52 billion development budget for 50 projects in 2025-26