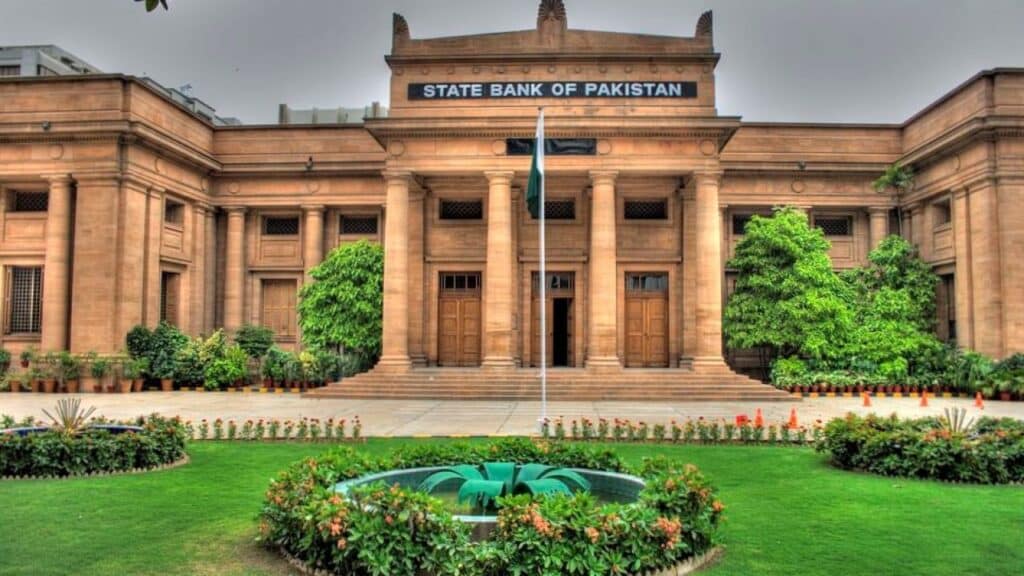

KARACHI: The State Bank of Pakistan (SBP) has unveiled its latest monetary policy, cutting the benchmark interest rate by 1%, from 12% to 11%, for the next two months.

The decision comes in response to growing calls from the business community and economists to lower borrowing costs and boost industrial activity.

Ahead of the announcement, there was speculation that the SBP might reduce the rate by 1 to 2 percentage points to encourage investment and lower the cost of doing business. The Federation of Pakistan Chambers of Commerce and Industry (FPCCI) had urged the central bank to bring the rate into single digits to stimulate economic momentum.

Industrialist Zaki Ejaz had argued for a steeper cut of at least 500 basis points, warning that elevated interest rates had effectively stalled industrial borrowing.

In contrast, financial analyst Atique-ur-Rehman had cautioned against a rate cut, highlighting the need for monetary stability, particularly for sectors such as pharmaceuticals that rely heavily on imported raw materials. He also underscored the importance of investment in critical areas like ports, fisheries, agro-processing, and livestock farming, which require a stable financial environment.

Atique further noted that consistent interest rates are vital for senior citizens, welfare organisations, and pensioners, whose livelihoods depend on returns from long-term savings. He pointed out that the IMF has continued to urge Pakistan to maintain a tight monetary stance, even as anticipated foreign inflows have yet to materialise.

Experts agree that any shift in the policy rate can significantly influence inflation, exchange rates, exports, and overall market sentiment. The SBP’s latest move will likely shape the economic landscape in the months ahead.

Read Also: PM invites UK to join neutral int’l probe into Pahalgam incident