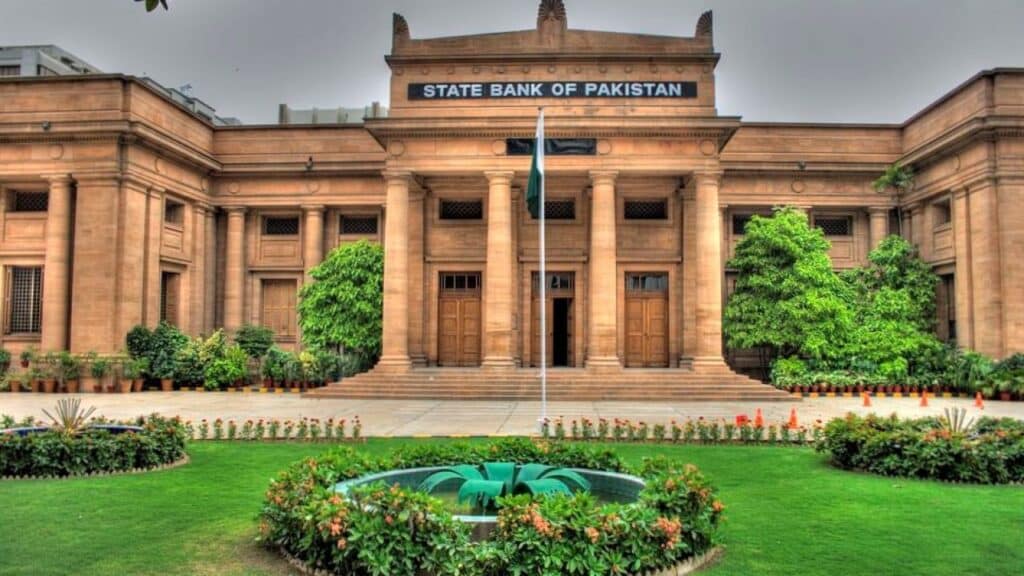

A rate cut is likely as the State Bank of Pakistan is set to announce its monetary policy tomorrow, Monday.

The State Bank of Pakistan will announce a new monetary policy for two months tomorrow, with the business community, investors and economists anxiously awaiting a possible change in the interest rate.

According to sources, there is a possibility of a one to two per cent reduction in the current 22 per cent interest rate, which is aimed at reducing business costs, reviving industrial activities and reactivating the economic wheel. The Vice Chairman of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) has demanded that the interest rate be brought down to single digits immediately, so that investment in the country can be promoted.

Renowned industrialist Zaki Ijaz says that a reduction of at least 500 basis points (five per cent) is inevitable to manage the economy, as industrial borrowing has almost stopped due to the current high interest rate.

On the other hand, economic and financial analyst Atiqur Rehman has preferred “status”, i.e. stability in the interest rate in the current difficult circumstances. According to him, the import of raw materials, especially for the pharmaceutical industry, is possible only when the cost of funding is low. However, he said that at present the country needs urgent investment in ports, fish harbours, processing units and agricultural and livestock farming, for which financial stability is a basic condition.

Read also: IMF dismisses India’s request to block Pakistan’s financial aid

Atiqur Rahman said that it is also important for senior citizens, welfare institutions and pensioners whose income is linked to long-term savings to maintain the current level of interest rates so that their daily needs can be met. He said that the IMF has also emphasised to Pakistan to maintain a tight fiscal policy, while potential foreign financial inflows have not been received yet.

Experts say that any change in interest rates will not only have a direct impact on market confidence but will also have significant effects on inflation, currency value, exports and borrowing. In this context, the State Bank’s decision tomorrow plays a key role in determining the direction of the country’s economy.